Legal Fees and Criminal Charges

Given the cost of legal fees, their deductibility is an important issue for most clients. For tax purposes, an individual’s business income… Read more

Given the cost of legal fees, their deductibility is an important issue for most clients. For tax purposes, an individual’s business income… Read more

There are two forms of tax avoidance: (1) Lawful tax mitigation; and (2) “Abusive” tax avoidance. Tax mitigation refers to lawful avoidance… Read more

Millions of employees forced to work from home because of COVID-19 turned their bedrooms, basements, and kitchens into workspaces. In doing so,… Read more

Tax rules protect the Tax Collector. They are not intended to protect taxpayers. Taxpayers who do not comply with the rules lose… Read more

There are very few rules in tax law that protect taxpayers. Most are written to protect the Canada Revenue Agency and the… Read more

The government is desperate for money and is on the search for new sources of revenues to finance its deficits. In anticipation… Read more

Behavioural economists advise that spending money, such as paying taxes, has psychological cost – the pain of paying. What they do not… Read more

Spring is the season to reflect on what we pay for through our taxes. We have a new federal Budget coming on… Read more

“When there is an income tax, the just man will pay more and the unjust less on the same amount of income”…. Read more

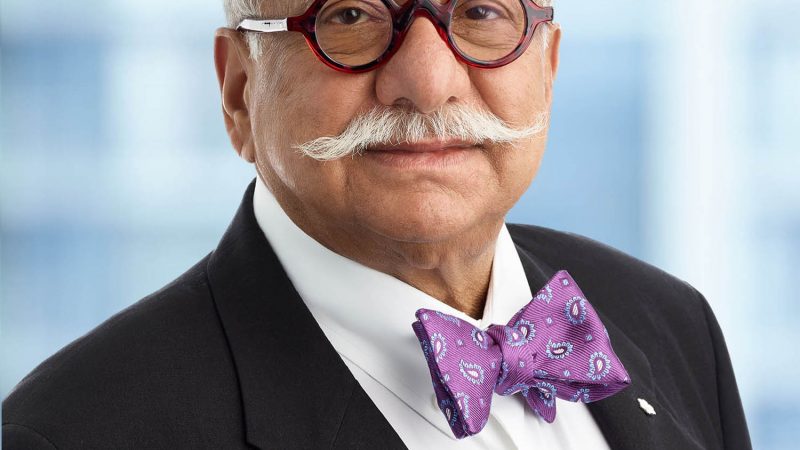

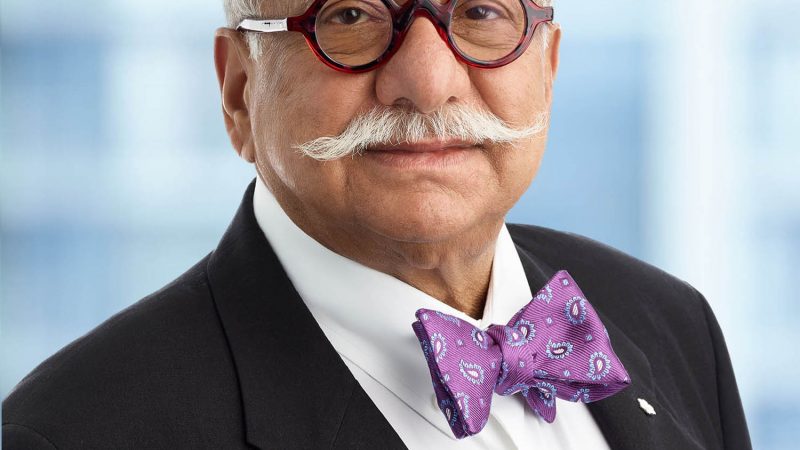

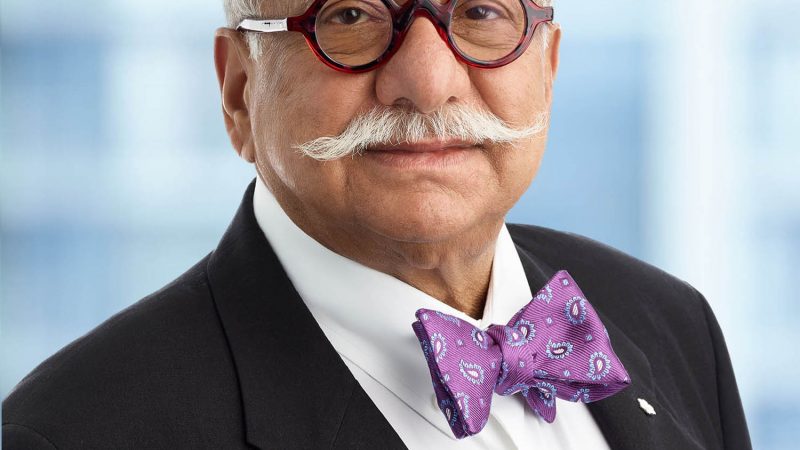

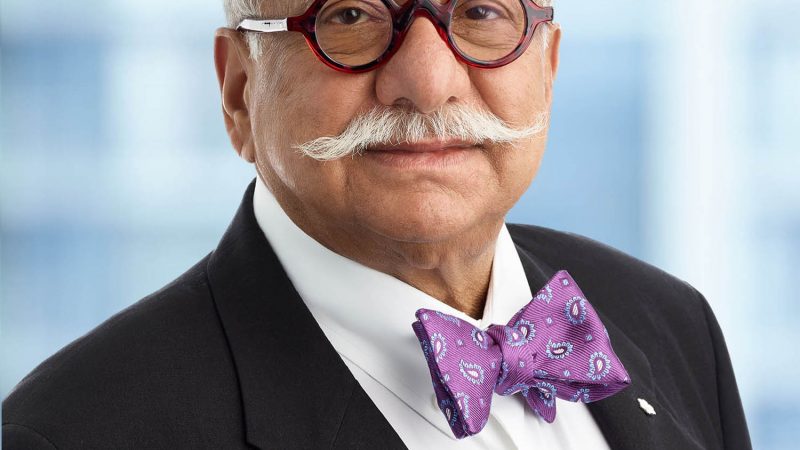

By: Vern Krishna, CM, QC – Counsel, Tax Chambers LLP (Toronto) Even in death, Alphonse (Al) Capone’s legacy in tax law thrives… Read more